Understanding Competitive Exness Fees in the Forex Market

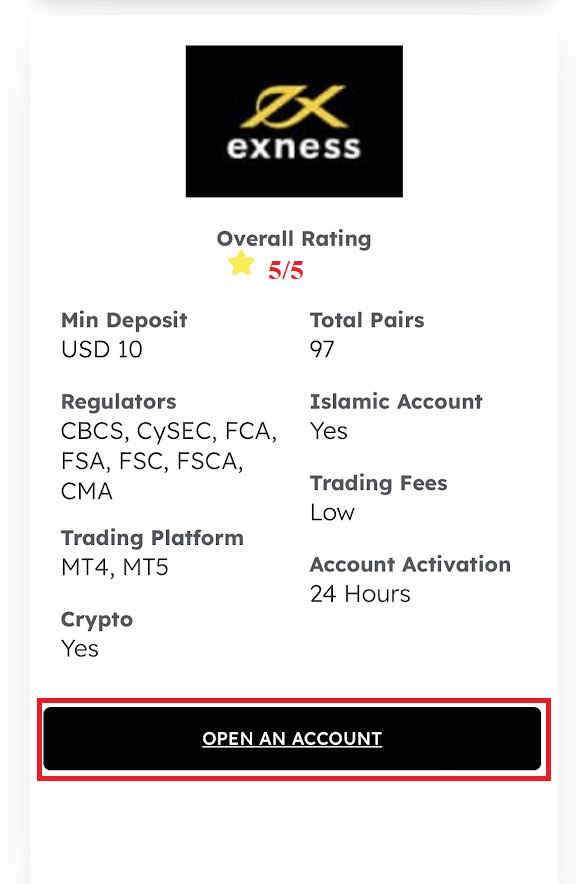

In the world of forex trading, understanding the various fees associated with different brokers is crucial for maximizing potential profits. One of the competitive players in the industry is Exness, known for its user-friendly platform and transparent fee structure. This article delves into the details of competitive Exness fees, helping traders grasp how costs can impact their trading strategies. Additionally, we will touch on the importance of choosing the right broker in conjunction with trading costs, offering a comprehensive view of the expenses involved. You can also check Competitive Exness Fees http://self.gridlearn.com/exness-app-smart-integrated-application-from-6/ for insights into using Exness applications effectively.

What Are Exness Fees?

Exness fees encompass various costs that a trader may incur, including spreads, commissions, overnight fees, and withdrawal fees. It’s essential to understand each facet to navigate the intricacies of forex trading efficiently.

1. Spreads

Spreads are the difference between the buying (ask) price and the selling (bid) price of a currency pair. Exness offers both fixed and variable spreads, depending on the account type selected. Typically, variable spreads on popular currency pairs can start from as low as 0.0 pips, especially with the True ECN account, entailing competitive pricing. Meanwhile, fixed spreads provide predictability, which can be advantageous for traders who prefer stability over fluctuating costs.

2. Commissions

In addition to spreads, brokers may charge commissions per trade, particularly in accounts that feature tighter spreads like ECN accounts. Exness maintains a competitive edge here, with commissions as low as $3.5 per lot per side. This pricing structure ensures that even high-volume traders can take advantage of lower trading costs, ultimately improving their profitability.

Understanding Account Types

Exness offers several account types, each structured differently regarding fees:

- Standard Account: No commissions, variable spreads starting from 0.3 pips.

- Raw Spread Account: Low variable spreads starting from 0.0 pips, with a commission of $3.5 per lot.

- Pro Account: For experienced traders, offering tighter spreads and a commission structure similar to the Raw Spread account.

Selecting the right account type is paramount as it directly affects the total trading costs. For beginners, a Standard account may suffice, while professional traders may benefit more from the Raw Spread or Pro accounts.

3. Overnight Fees (Swap Rates)

Exness, like many brokers, applies swap rates for positions held overnight. These fees can either be positive or negative, depending on the currency pair and direction of the trade. Understanding swap rates is critical for traders, especially those engaging in long-term trading strategies. Exness provides a swap-free option for clients who prefer not to incur overnight fees due to religious beliefs.

4. Deposit and Withdrawal Fees

Another consideration for traders is the cost associated with deposits and withdrawals. Fortunately, Exness is known for offering a range of payment methods with no fees on deposits, including bank transfers, credit/debit cards, and e-wallets. However, withdrawal fees may apply depending on the chosen method. For instance, while e-wallet withdrawals can be processed without fees, bank withdrawals may incur charges.

Comparing Exness Fees with Other Brokers

To truly grasp the competitive nature of Exness fees, it’s essential to compare them to those of other brokers in the industry. Brokers like IG, OANDA, and Forex.com may have varying fee structures. For example:

- IG: Offers competitive spreads but higher commissions on some account types.

- OANDA: Known for a range of assets but often higher average spreads compared to Exness.

- Forex.com: Competitive, especially on major pairs, but may impose higher inactivity fees.

By analyzing competing offerings, traders can make a more informed decision when choosing a broker. With Exness, the transparency in fee structure can often make a significant difference in overall trading performance.

Conclusion

In conclusion, understanding the competitive Exness fees is essential for traders seeking to optimize their trading costs. With a variety of account types, low spreads, and transparent pricing, Exness positions itself as a broker that caters to both novice and experienced traders alike. When selecting a broker, consider the full scope of fees, including spreads, commissions, overnight fees, and withdrawal costs, as these factors will shape your trading experience.

By choosing a broker like Exness with a competitive fee structure, traders can potentially maximize their profitability and reduce trading expenses, ultimately enhancing their overall trading strategy.